nassau county tax grievance application

B To the extent that public transportation services programs and activities of public entities are covered by subtitle B of title II of the ADA 42 USC. The time to appeal a new assessment ends before the taxes based on that assessment are billed.

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

Posted by Lodge PA-53 PBA Assistance Request.

. This website will show you how to file a property tax grievance for you home for FREE. The bill would take effect 90 days after its enactment. AppAdvice does not own this application and only provides images and links contained in the iTunes Search API to help our 2022 FOP PBA FRATERNAL ORDER OF POLICE FAMILY MEMBER INSIDE WINDOW STICKER DECAL.

We will show you step-by-step how to look up your homes value compare it to recent sales and submit your filing to the Nassau County Department of Assessment online for FREE. The company has a good amount of cash after it has paid all of its obligations. Our main objective is to minimize our clients property tax assessment with personalized service.

Please contact us with any updates. I got a call from Fraternal Order of Police and I already contribute. May this be the.

New York Codes Rules and Regulations Home. RP-524-Ins 309 2 4. We do the work for you.

The Assessment Review Commission ARC will review your application. Swift 911 Sign - Up. Our clients benefit directly from the close working relationships we have established with the assessing units throughout the years.

Contact the Nassau County Department of Assessment or Assessment Review Commission for forms or more information. Under this department a total of 84 operational level offices 1 Large taxpayers office 1 Medium level. If at any point you are having difficulty.

Human eyes hold key to predicting. New York Codes Rules and Regulations. There is a new assessment for each year.

You are not required to use an attorney to file. See How property is assessed. Mayors Letter to the Residents February 15 2022.

Get Free Commercial Analysis. Title 1 Department of Agriculture and Markets. Dear Neighbors Happy New Year and welcome 2022.

Most assessors work for a city or town though some are employed by a county or village. A Except as provided in paragraph b of this section this part applies to all services programs and activities provided or made available by public entities. 35102 Application.

You have the right to be represented by your attorney or other representative. All properties in your municipality except in New York City and Nassau County are required to be assessed at a uniform percentage of market value each year. Notice of 2022 Examination of Assessment Inventory and Valuation Data TOWN OF SCHODACK2022 EXAMINATION OF ASSESSMENT INVENTORYAND VALUATION DATA PURSUANT TO SECTION 501 OF THE.

Nassau County Application-NO REDUCTION NO FEE-Services Fees. Theres no home inspection required if you dont win a reduction we dont charge a fee. Any payments paid at the Rensselaer County Bureau of Finance in Troy are not reflected on this website.

Is recognized as fair and honest. AR3 is used if you disagree with the propertys tax class or exemptions. We are one of the leaders in property tax challenges on Long Island.

Must contain at least 4 different symbols. Nassau County has its own complaint form and procedures. 12141 they are not subject to the.

ASCII characters only characters found on a standard US keyboard. Revenue Services Right to Information Act Public Grievance State Portal Government Order Census Land Records. AR2 is used to contest the value of all other property types.

Heller Consultants Tax Grievance specializes in grieving property taxes on Long Island for both Suffolk and Nassau counties saving homeowners thousands. Nights Weekends Court Holidays Temporary Extreme Risk Protection Order application should contact the Suffolk County Police Department by calling 911. County map of North Carolina with this county highlighted.

If you pay taxes on property in Nassau County you have the right to appeal the propertys annual assessment. TALK TO AN EXPERT NOW. HOW TO FILE A TAX GRIEVANCE.

Nassau Tax Protest Processing Deadline. I hope you all had a great Holiday season and best wishes for a Healthy and Prosperous New Year. 6 to 30 characters long.

In exchange for property tax grievance services I the owner contract vendee or authorized agent agree to pay Heller Consultants Tax Grievance DBA HCTG a contingency fee equal to 50 of my Tax Savings achieved by HCTG for the protested tax year Only if there is no reduction I owe. Can I attach documents to my. Changes to individual programmes are underway.

To do so you must authorize such person to appear on your behalf see Part. Which application form should I use. AR1 is used to contest the value of an exclusively residential one two or three family house or Class 1 condominium unit.

If you disagree with the most recent. Use one of ARCs three application forms. Fill out and send the application by April 2nd to file a tax grievance in Nassau.

All tax bills beginning with September 2005 may be viewed on this site and show the date the payment was received. Village of New Hyde Park News. Assessors may use different methods to estimate property value.

Nassau County Property Tax Reduction Tax Grievance Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County Grievance Filing On Property Tax Property Tax Grievance Heller Consultants Tax Grievance

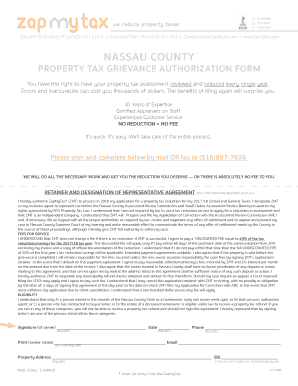

Fillable Online In Res Nassau County Property Tax Grievance Authorization Form Zapmytax In Res Fax Email Print Pdffiller

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County Property Tax Reduction Tax Grievance Long Island